SGS Market Timer Status: SHORT

SHORT as of the close of Friday December 9, 2022

Previous SGS Status

SGS is a Long-Term (weeks to months) Timer

Why Market Timing Is A Must

The US Economy is growing at

a healthy rate of 3.2% with a historic low level of unemployment (The Push). At the same time, the Federal Reserve is aggressively raising rates and reducing its balance sheet (The Pull). This Push and Pull is the reason why major indices have been on a roller coater ride to nowhere for the last few month. The ride to nowhere very likely continues for a while, maybe a long while.

SGS Market Timer

As of the close of last Friday (12/23), the value of SGS was calculated to be -335 and the status of SGS remains SHORT.

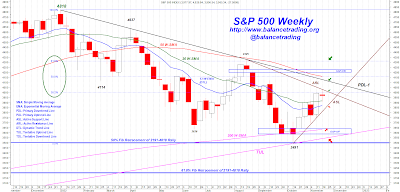

S&P 500 Support And Resistance Levels

Support and resistance levels for SPX for this week are shown above. No change since last week, at this point there is a reasonable chance that SPX tests the support that exist around its October low (≈3500). Should that support fail, then SPX would sell further to test 3200 level which is also 61.8% Fib. retracement level of the Covid rally (2191 to all-time high 4818

).

I am planning to continue to stay in cash and open new positions sometime in the first week of 2023.

Merry Christmas & Happy New Year

SPX: S&P 500 Index SMA: Simple Moving Average

DJI: Dow Jones Industrial Index EMA: Exponential Moving Average

DJT: Dow Jones Transportation Index PDL: Primary Downtrend Line

NAZ: NASDAQ Composite Index PUL: Primary Uptrend Line

RUT: Russell 2000 Index ASL: Active Support Line

OEX: S&P 100 Index ARL: Active Resistance Line

NDX: NASDAQ 100 Index DTL: Dynamic Trend Line

TUL: Tentative Uptrend Line TDL: Tentative Downtrend Line

TLR: Trend Line Resistance TLS: Trend Line Support

Disclaimer: The views expressed are provided for informational purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.