SGS Market Timer Status: SHORT

SHORT as of the close of Friday November 4, 2022

Previous SGS Status

SGS is a Long-Term (weeks to months) Timer

Why Market Timing Is A Must

SGS Market Timer

As of the close of last Friday (11/18), the value of SGS was calculated to be -111 and the status of SGS remains SHORT.

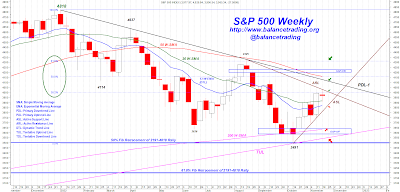

S&P 500 Support And Resistance Levels

My Plan

I am 95% in cash and planning to wait to see what SPX does this week.

SPX: S&P 500 Index SMA: Simple Moving Average

DJI: Dow Jones Industrial Index EMA: Exponential Moving Average

DJT: Dow Jones Transportation Index PDL: Primary Downtrend Line

NAZ: NASDAQ Composite Index PUL: Primary Uptrend Line

RUT: Russell 2000 Index ASL: Active Support Line

OEX: S&P 100 Index ARL: Active Resistance Line

NDX: NASDAQ 100 Index DTL: Dynamic Trend Line

TUL: Tentative Uptrend Line TDL: Tentative Downtrend Line

DJI: Dow Jones Industrial Index EMA: Exponential Moving Average

DJT: Dow Jones Transportation Index PDL: Primary Downtrend Line

NAZ: NASDAQ Composite Index PUL: Primary Uptrend Line

RUT: Russell 2000 Index ASL: Active Support Line

OEX: S&P 100 Index ARL: Active Resistance Line

NDX: NASDAQ 100 Index DTL: Dynamic Trend Line

TUL: Tentative Uptrend Line TDL: Tentative Downtrend Line

Disclaimer: The views expressed are provided for informational purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.