Long Term Current and Past Portfolios

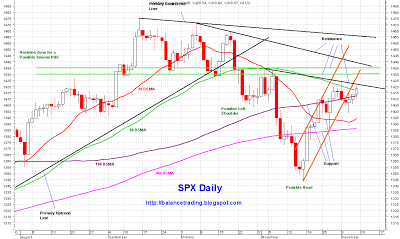

The rally that started on 11/16 is running to stiff resistance. On weekly charts, except for NAZ, the uptrend in all major indices is still intact. For daily charts, it is a different story. Except for DJI, the uptrend in all major indices has been broken.

Indices are predicting a drawn out budget fight in DC. A fight that is not going to be settled until Big Money scares everyone into an agreement by pushing indices down 3% to 5% for a couple of days or so. Those down days would be excellent buying opportunities.

My plan is to close all my long positions in both long term portfolios (RTS and RTS Div) and open new long positions during upcoming sell off. I think SPX 1425 to 1435 is a good range to sell into.

Face Book

Disclaimer: The views expressed are provided for information purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.

Disclaimer: The views expressed are provided for information purposes only and should not be construed in any way as investment advice or recommendation. Furthermore, the opinions expressed may change without notice.